VAT Tax Impact on Resale in the UK

VAT Tax Impact on Resale in the UK

As part of a global effort to clamp down on tax evaders, the HM Revenue & Customs (HMRC) has signed new rules to request information from digital platforms like Vinted or eBay to report the income sellers are getting through their site routinely.1 These regulations encompass the sale of various items, including handcrafted or upcycled goods, as well as second-hand items like clothing or furniture.

Starting in January 2024, companies such as Vinted and Vestiaire Collective are mandated to periodically collect and share transaction details from sellers who are making over €2,000 in income a year or over 30 sales, a departure from the previous system that was based on self-reporting.

Since 2017, all U.K. citizens get up to £1,000 each tax year in tax-free allowance for trading income, spanning activities from self-employment to more casual services like babysitting or online clothing sales. If an individual is making less than £1,000 yearly in trading income, they are not obligated to pay tax, and if your expenses are higher than your income, it could be beneficial to submit all documentation to access full relief.2

Impact on Resale Platforms

The new rules do not affect existing businesses already meeting their tax obligations. The main change these regulations bring is enhanced data collection and sharing procedures with the relevant authorities. But while the ultimate objective of these rules is to combat tax evasion, there is a potential unintended consequence on the circular economy.

“Our preliminary findings report that the vast majority of our sellers are not affected by the new VAT rules in the UK, due to the threshold set on the net profit earned vs. the original price paid. Ultimately, it is imperative that we don’t let new rules confuse or scare people away from circularity and resale.” — Sofia Gazotti, VP Brand Partnerships, reflaunt

These regulations might inadvertently discourage individuals from selling their pre-loved items and extending the lifetime of their second-hand goods. It is crucial to recognise the role that individuals can play in preventing clothes from ending up in landfills or incinerated, eventually contributing to the development of a thriving circular and sustainable fashion industry. Buying a used garment extends its life on average by 2.2 years, which reduces its carbon, waste, and water footprint by 73%.3 Not to mention that the second-hand industry contributes to the wider national economy through job creation and consumer spending.

In a world where the average garment lasts only seven uses before it is tossed away and with the annual production of textile waste globally reaching an alarming 92 million tonnes, governments should implement policies that encourage, rather than deter, citizens’ participation in the circular economy. In doing so, we can collaboratively work to reduce the environmental footprint of the fashion industry, whilst contributing economic vitality through the second-hand market.

What can you do as a consumer?

- To avoid unpleasant surprises at the end of the tax year, make sure to keep track of all your transactions.

- Ignorance is not bliss. Take the proactive step of acquainting yourself with the rules and regulations, gaining a comprehensive understanding of their implications for you or your business.

- More importantly, continue to embrace the resilience of the second-hand community and continue adding vitality to the circular economy.

Other Articles

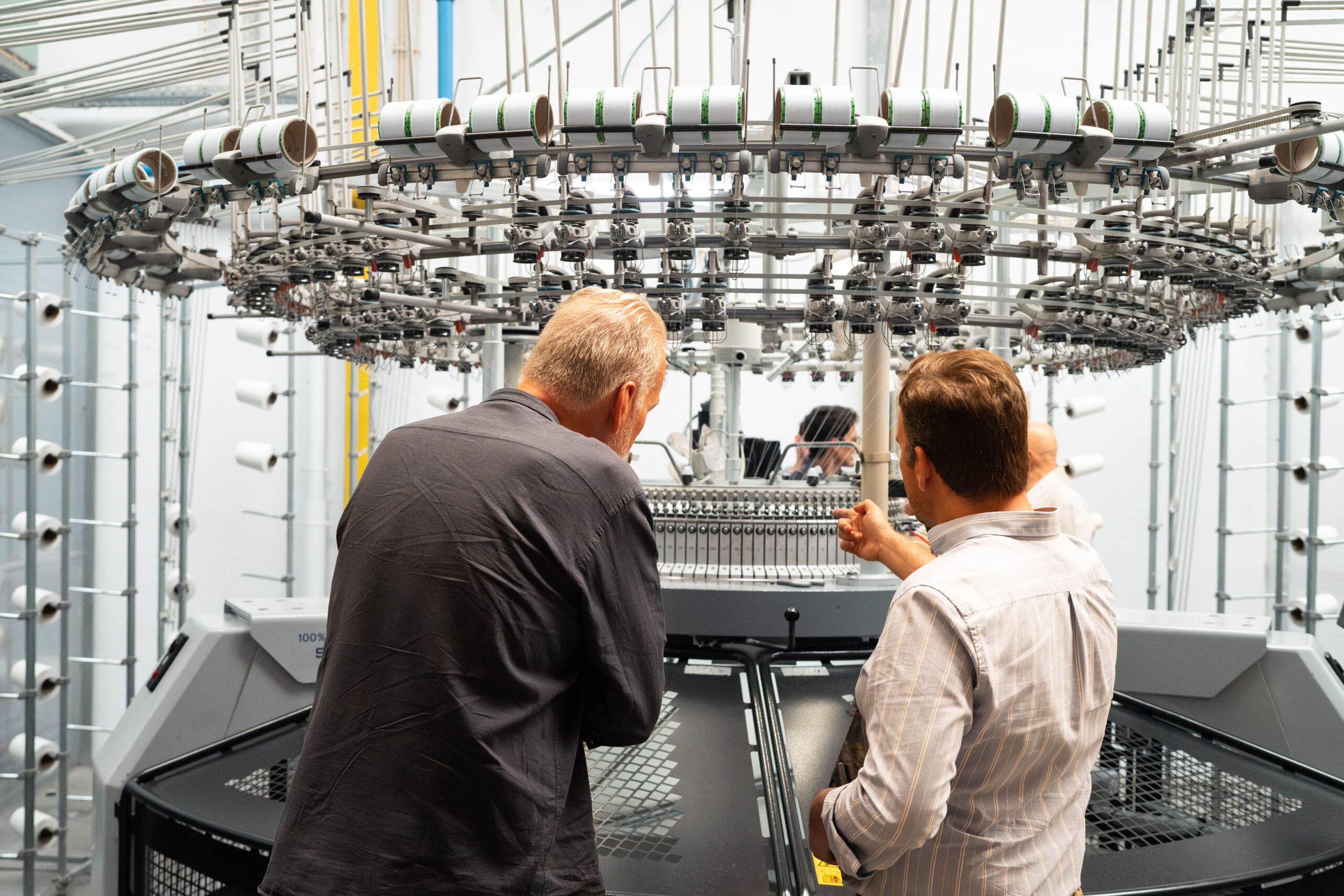

In conversation with Smartex: Explore Smartex’s AI-driven solutions transforming quality control and reducing waste

Fashion for Good and Textile Exchange Team Up to Trace Textile Waste