Fashion for Good and Spring Lane Capital Report Defines How Project Finance Can Bridge the Innovation Commercialisation Gap

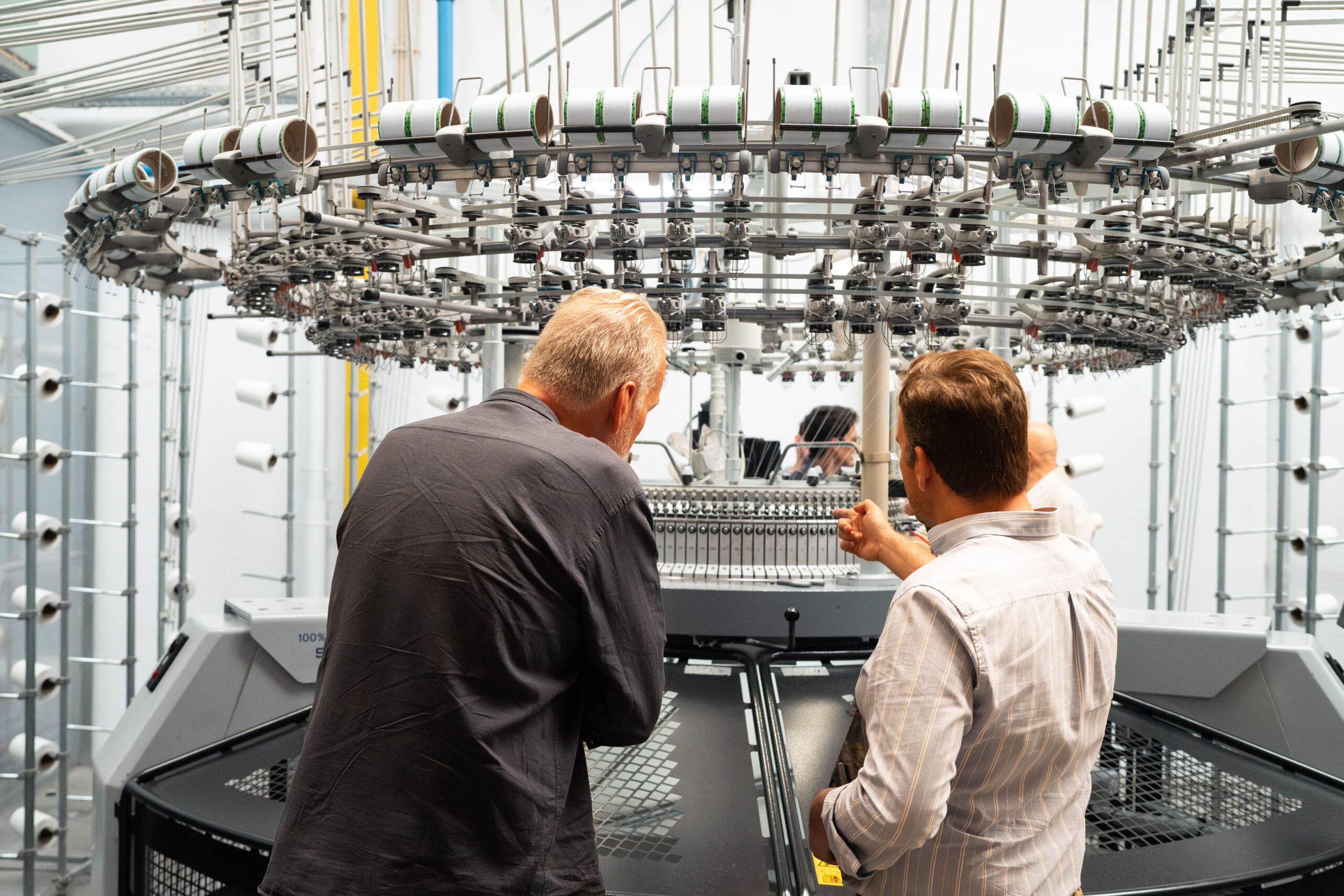

Image by Lalit Kumar via Unsplash.

19 OCTOBER 2023

AMSTERDAM / BOSTON – Fashion for Good has teamed up with Spring Lane Capital to help unlock the capital needed to scale sustainable innovation in the textile industry. Their new report, “The Great Unlock: Closing the innovation commercialisation gap through project finance solutions”, reviews the different types of capital available to close the funding gap within the commercialisation stage. It discusses the benefits, requirements and opportunities related to project finance as a funding solution in this space, and highlights the roles that various stakeholders would need to play in order to bring this to life.

This report aims to enhance innovators’ understanding of relevant industry stakeholders and ultimately assists in further enabling the scaling of much needed innovation.

“Innovation is key for industry transformation and project finance is a critical enabler to bridge the commercialisation funding gap. With this report, we’re excited to share relevant learnings and a call to action: to innovators, brands, financiers, and supply chain partners who all have a role to play to unlock this type of funding.” — Katrin Ley, Managing Director, Fashion for Good

In line with keeping global warming below 1.5 degrees, the fashion industry is currently in a race to achieve net zero by no later than 2050. While existing solutions can significantly help reduce the impact of the industry, the scaling of innovations — in particular in next-generation materials, recycling and processing — is critical to enable a transition towards a net zero industry.

The path to scaling these innovations, however, is fraught with financial hurdles. The transition from R&D to commercial viability demands substantial capital, and innovators often face a financing challenge when they arrive at this first commercial production stage. This results in a funding gap that prevents industry-wide adoption of new products and technologies.

The bulk of the funding needed will come from debt financing, with project finance serving as a key solution due to the strong focus on risk mitigation and allocation, which the structured nature of such funding provides.

“Sustainability imperatives have already disrupted the energy and mobility sectors, while at the same time creating enormous opportunity. It’s clear to us that the fashion industry is at a similar inflection point. Spring Lane looks forward to providing capital and expertise to help accelerate the ongoing transition in the fashion sector.” — Christian Zabbal, Managing Partner, Spring Lane Capital

PROJECT FINANCE: THE CATALYST FOR SCALING INNOVATION

Project finance is a specialised type of financing in which the project’s assets and cash flows serve as collateral for the loans used to finance the project. Project finance distinguishes itself by mitigating risks, bolstering credit ratings, and allowing for greater borrowing capacity based solely on the project’s viability. It thereby offers a lifeline to innovators who may lack creditworthiness in traditional financing channels.

Project finance is particularly beneficial for new technologies because it allows them to scale effectively and faster compared to traditional funding channels. Project finance also gives access to broader debt capital markets and offers longer repayment periods compared to corporate finance, making it more attractive for technology development.

“There is a lot of investor interest in new technologies, and scope for project finance as a funding mechanism – especially for proven solutions like ours where market demand is high and the positive environmental impact so clear. In the last few years, we have signed major offtake agreements with leading brands. Based on those experiences, we see this report as a valuable toolkit to help especially the new innovators prepare for the funding journey that lies ahead.” — Petri Alava, CEO, Infinited Fiber Company

A COLLECTIVE CALL TO ACTION

Innovators, brands, financiers, and supply chain partners all have a role to play to unlock the funding needed to bridge this commercialisation funding gap.

- Innovators – Build Expertise & Plan Ahead: Align development milestones with a robust capital strategy, ensuring the presence of technical, operational, and financial expertise from the outset.

- Brands – Signal Demand: De-risk project finance by signalling demand through direct or supply chain partner offtake agreements.

- Supply Chain Partners – Multi-level Engagement and Ownership: Contribute through signalling demand, providing technical expertise, and capital allocation via joint ventures.

- Financiers – Actively Pursue Opportunities: Advance industry expertise and collaborate with brands, supply chain partners, and innovators to craft investment propositions that match risk-return profiles.

Fashion for Good and Spring Lane Capital are actively mobilising these stakeholders accordingly, kicking it off at Fashion for Good’s Annual Summit on 19/20 October in Amsterdam, as well as Spring Lane Capital’s Developer U event on 24/25 October in New York.

“Partnering with innovators in scaling their technologies allows us to accelerate the availability of, and secure access to, novel materials and processes that are crucial for the achievement of our sustainability goals.” — Carolin Lanfer, Director Corporate Ventures – Sustainability, adidas

KEY FINDINGS FROM THE REPORT:

- Complex Scaling Phases: Scaling innovations, specifically next-gen materials and processing technologies, will require significant allocations from a capital, time and expertise perspective.

- Commercialisation Funding Gap: Debt financing, which represents 50% or $200Bn of the financing required to scale those innovations, plays a substantial role and can be unlocked through project finance solutions.

- Project Finance as Catalyst: Project finance allows innovations to scale faster and more effectively, compared to traditional funding channels.

- Prerequisites for Project Finance: Strong offtake, feedstock, and Engineering, Procurement, and Construction (EPC) contracts are vital for project success.

- Call-to-Action: Innovators, brands, financiers, and supply chain partners all have a role to play to unlock the funding needed to bridge this commercialisation funding gap.

The report provides contractual templates, and highlights case studies and lessons learned from innovators during their scaling journey.

The full report can be downloaded here.

Other Articles

In conversation with Smartex: Explore Smartex’s AI-driven solutions transforming quality control and reducing waste

Fashion for Good and Textile Exchange Team Up to Trace Textile Waste